How AI is Transforming Finance and Banking?

Introduction

Finance and banking are the backbone of global economic systems. From personal savings and loans to complex corporate financing and international trade, this industry affects every level of society. Traditionally characterized by manual processing, human judgment, and regulatory rigidity, the sector has begun a profound digital transformation. At the heart of this shift is Artificial Intelligence (AI)—a technology that is automating processes, enhancing decision-making, reducing risks, and delivering customer experiences at a scale never seen before.

But AI is more than just a tool—it's a strategic enabler. It allows institutions to operate with real-time intelligence, personalize services, and detect fraud even before it happens. In this blog, we dive deep into how AI is revolutionizing finance and banking across six key touchpoints.

1. Fraud Detection and Prevention

Traditional vs AI-Driven Fraud Detection

In the past, fraud detection relied heavily on static rule-based systems—if a transaction exceeded a certain amount or occurred from an unfamiliar location, it was flagged. But cybercriminals evolved faster than these systems. Now, with AI, institutions can stay ahead by using dynamic, data-driven models.

How AI Helps:

- Real-Time Pattern Recognition: AI models like neural networks and decision trees analyze massive datasets—transaction history, geolocation, device ID, IP addresses, and more—to find anomalies.

- Continuous Learning: Machine learning (ML) algorithms improve over time, adapting to new fraud techniques without manual updates.

- Behavioral Biometrics: Advanced systems track typing speed, mouse movements, and mobile gestures to confirm user identity.

Real-World Examples:

- PayPal uses deep learning models to analyze billions of transactions and reduce false positives—improving user experience while staying secure.

- American Express leverages AI to build a risk profile for every cardholder, helping detect fraud within milliseconds.

- Darktrace and other AI cybersecurity firms are helping banks proactively identify threats using unsupervised learning.

2. Personalized Financial Services

What Customers Want:

Today’s digital-savvy customers demand tailored financial solutions, not one-size-fits-all products. AI enables institutions to use deep data insights to create hyper-personalized financial journeys.

AI Applications in Personal Finance:

- Predictive Personalization: AI suggests financial products or savings plans based on life stage, spending habits, goals, and even seasonal patterns.

- Voice-Powered Advisors: Integration with Alexa, Google Assistant, or in-app chatbots helps users set budgets, track expenses, and plan savings with voice commands.

- Smart Budgeting Tools: AI-driven apps like Cleo or YNAB provide real-time financial advice using natural language and emojis, especially for Gen Z and millennials.

Example:

- Capital One’s Eno and Bank of America’s Erica go beyond basic queries—they track subscriptions, warn about duplicate charges, and offer insights on spending trends.

- Revolut uses AI to provide real-time analytics, categorize expenses, and even offer cryptocurrency trading recommendations.

3. Loan Underwriting and Credit Scoring

The Shift from Traditional Credit Bureaus

Millions around the world—especially in developing economies—lack formal credit histories. Traditional credit scores are rigid and often exclude viable borrowers. AI is changing this by evaluating alternative data.

What’s New with AI in Lending:

- Alternative Data Sources: AI models can now include rent payments, e-commerce purchases, utility bills, mobile phone usage, even psychometric data.

- Faster Decision-Making: AI reduces loan approval time from days to minutes.

- Microloan Models: Platforms like Kiva and Tala use AI to lend to individuals in rural or underserved regions.

Ethical Considerations:

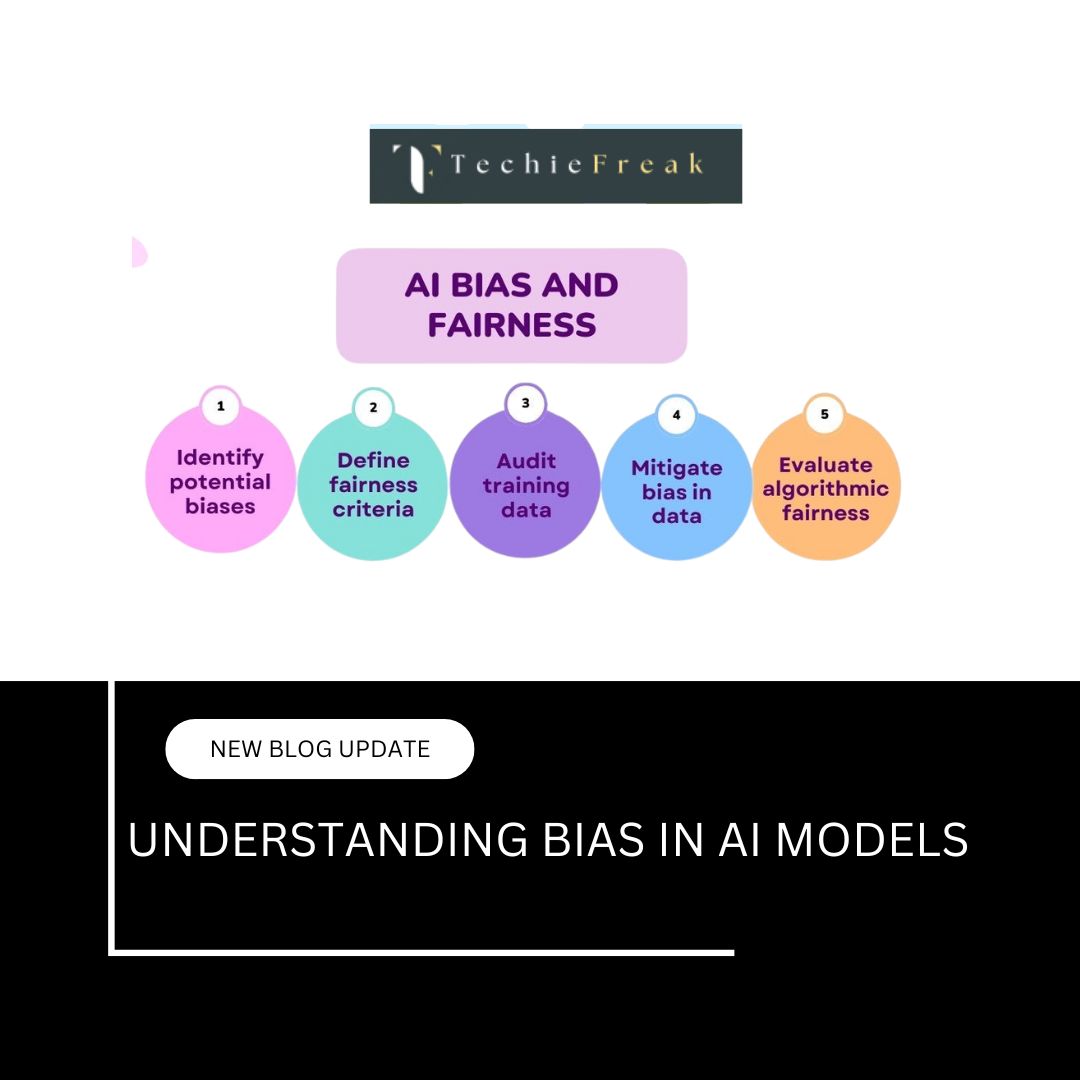

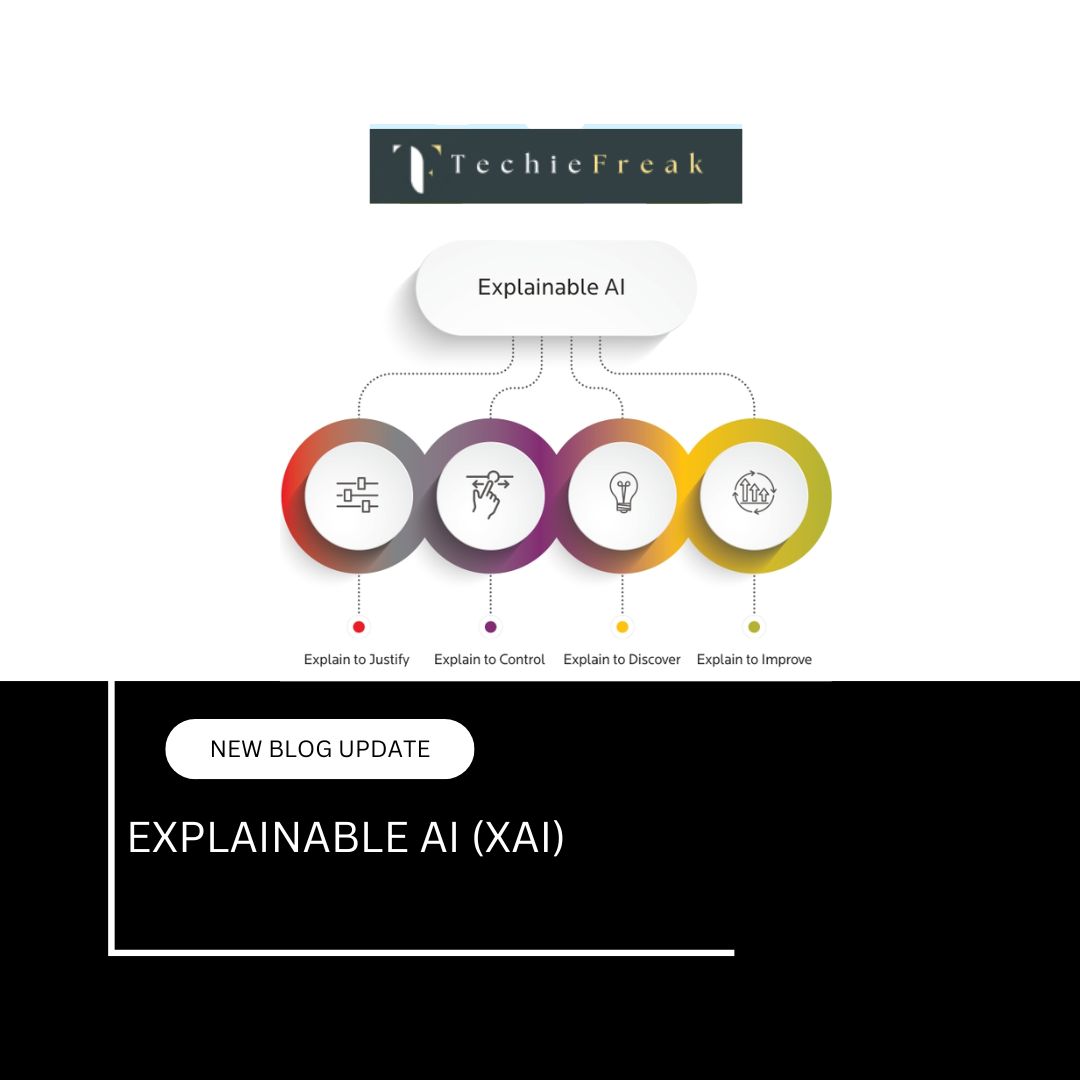

- Algorithmic Bias: AI can inherit societal biases. For example, if historical data reflects discrimination, the model may too.

- Solution: Use Fairness-Aware ML models, regular audits, and regulatory frameworks like Explainable AI (XAI) to ensure transparency.

Example:

- Zest AI helps lenders make better underwriting decisions using AI models that improve approval rates without increasing risk.

- Upstart, an AI lending platform, reports 27% more approvals and 16% lower average APRs compared to traditional models.

4. AI in Trading and Investment Management

From Gut Instinct to Algorithmic Precision

Markets are volatile and driven by a mix of logic, sentiment, and macroeconomic variables. AI enables trading systems to process millions of data points per second and execute trades faster and more accurately than any human.

Applications:

- High-Frequency Trading (HFT): AI systems use price data, order book info, and historical trends to perform trades in microseconds.

- Sentiment Analysis: AI reads news articles, social media, and financial reports to predict market sentiment and adjust strategies accordingly.

- Robo-Advisory Platforms: Platforms like Schwab Intelligent Portfolios, Betterment, and Wealthfront automatically rebalance portfolios based on market movements and user preferences.

Example:

- BlackRock’s Aladdin Platform is a comprehensive AI-powered investment tool used for managing risks and making portfolio decisions across $20+ trillion in assets.

- Goldman Sachs’ Kensho uses AI to analyze geopolitical events and predict their potential market impact.

5. Risk Management

Smarter Risk Forecasting

AI has redefined how financial institutions approach risk—from simple scorecards to predictive models that simulate entire economies.

Risk Categories Enhanced by AI:

- Market Risk: Predict how fluctuations in interest rates, exchange rates, or stock prices might impact portfolios.

- Credit Risk: Identify the probability of default based on dynamic borrower profiles.

- Operational Risk: Monitor and prevent internal process failures or cybersecurity breaches using AI surveillance systems.

Regulatory Compliance:

- AI-driven Natural Language Processing (NLP) tools scan and interpret massive volumes of regulatory texts to ensure banks stay compliant globally.

- Example: Ayasdi helps banks understand regulatory frameworks like KYC/AML through AI analysis of customer relationships and behavior.

6. AI Chatbots and Customer Experience

Beyond Basic Chat—Towards Intelligent Conversation

AI-powered chatbots are no longer limited to scripted responses. With Conversational AI, bots can understand context, tone, and even emotion.

Features:

- Multilingual Capabilities: Serve global users in their native languages.

- Transactional Support: Enable fund transfers, card blocking, bill payments, etc., within chat.

- Proactive Engagement: Bots notify users of unusual spending or upcoming bills before they ask.

Examples:

- SBI’s YONO app in India uses AI to combine lifestyle and banking in one platform.

- OCBC’s Emma chatbot in Singapore helps with goal-based financial planning and even educates customers about market trends.

Impact:

- 60–80% of customer queries can now be resolved without human intervention.

- According to Juniper Research, AI chatbots will save banks $7.3 billion globally by 2026.

Conclusion: A Future-Ready Finance Industry

AI is not merely an efficiency booster—it’s a game-changer. From democratizing access to credit and eliminating fraud to transforming investments and compliance, AI is redefining finance as we know it. Institutions that adopt AI now are not just becoming future-ready—they're shaping that future.

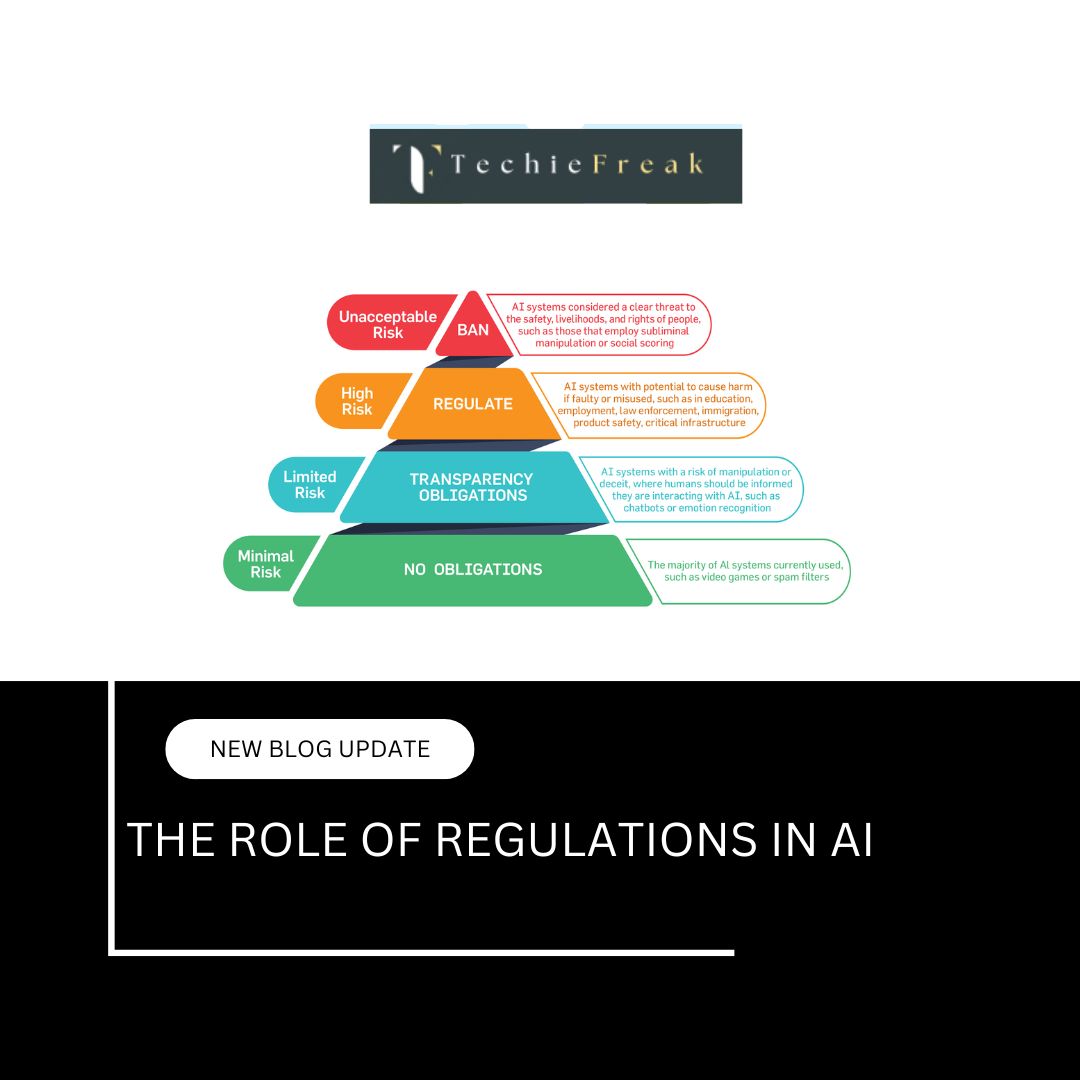

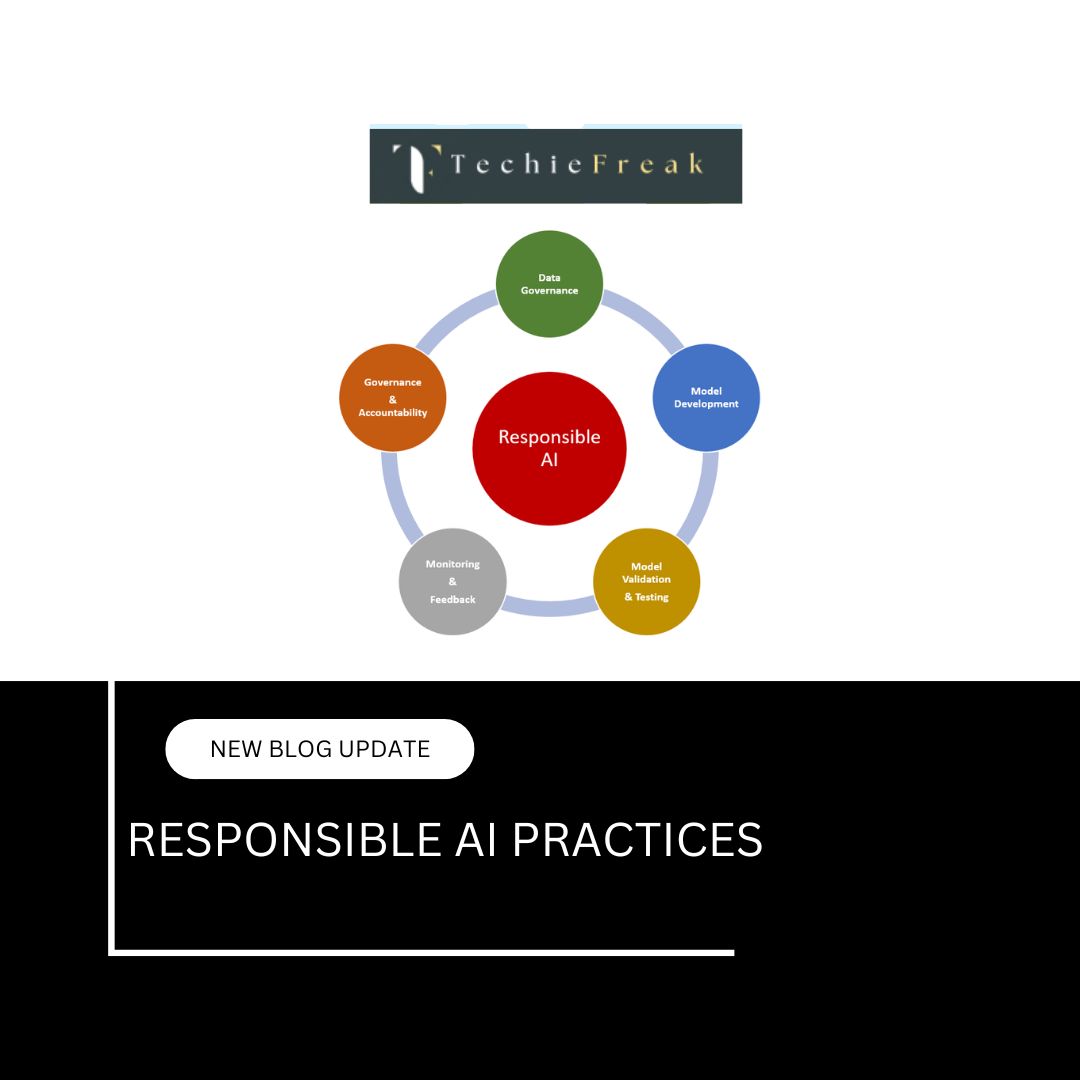

However, as AI's role expands, so does the need for governance, ethics, and human oversight. Regulators must ensure transparency, fairness, and accountability. Banks must ensure that their systems are explainable and inclusive.

The Bottom Line:

AI-powered finance is faster, smarter, safer—and more inclusive. The banks and financial platforms that integrate AI with responsibility and foresight will not only lead the market but also build trust, transparency, and resilience in the global economy.

.jpg)

.jpg)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)